If you have a business, the ability to apply for business credit cards gives you access to a plethora of options not available to others. That is once you’re able to convince a bank that you’re running an actual business. I went through that process to get the excellent business credit cards that Chase offers.

I’m not going to tell you to sign up for a business credit card if you don’t have a business. That’s something I will not do for Your Mileage May Vary. However, if you have a side business that has expenses (and hopefully income as well), you should be able to apply for a business card. Just be honest on the application.

Once I got a business card from Chase, the first card I signed up for was the Ink Business Preferred. Here are the reasons why it was at the top of my list:

Chase Ink Business Preferred

Annual Fee

$95 per year

Sign Up Benefits

This card currently offers a 100,000-point bonus if you spend $8,000 on purchases in the first three months after opening your account. If you book through the Chase portal, that’s worth at least $1,250 in travel. If you’re interested in signing up for any of the Chase Ink cards, we’d appreciate it if you used our referral link. We receive Ultimate Rewards points for each approved application.

Spending Bonus Categories

The Chase Ink Business Preferred earns 3X points on the first $150,000 spent in combined purchases in the following categories each account anniversary (not calendar) year.

- Travel

- Shipping Purchases

- Internet, cable and phone services

- Social media and search engine advertising

The card earns one point per dollar for all other spending with no limits to the total amount of points you can receive.

No Foreign Transaction Fees

As you would hope a card that’s focused on providing travel rewards would, the Chase Ink Business Preferred does not charge any foreign transaction fees.

Auto Rental Collision Damage Waiver

Another great feature of this card is that it acts as primary coverage when you rent a car. In normal terms, if you get in an accident in your rental car, you can use the coverage from Chase before filing a claim with your own insurance. Most other companies offer secondary coverage (where you need to file a claim with your auto insurance first). One important thing to remember is, coverage is primary when renting for business purposes.

Cell Phone Protection

Photo by Lisa Fotios on Pexels.com

With iPhones going for up to $1,500 for a top-of-the-line model, it makes sense to insure your phone for theft or damage. If you pay your cell phone bill with the Ink Preferred, you get up to $1,000 per claim if your phone is damaged or stolen. There’s a max of 3 claims in 12 months and a $100 deductible per claim.

Points are worth 1.25 cents each when using the Chase portal

If you book travel through the Chase portal, your Ultimate Rewards are worth 1.25 cents each. This isn’t the best value for your points but it is better than the 1 cent that you’ll get redeeming them for a statement credit.

Chase Ultimate Rewards can be transferred to other programs at a 1:1 value

Several programs partner with Chase, allowing you to move points to other programs. This will enable you to take advantage of the values in multiple programs without being locked into any particular one. Here are the partners of Chase Ultimate Rewards:

- AerLingus AerClub (Avios)

- Air Canada Aeroplan

- British Airways Executive Club (Avios)

- Flying Blue AIR FRANCE KLM

- Emirates Skywards

- JetBlue TrueBlue

- Iberia Plus (Avios)

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

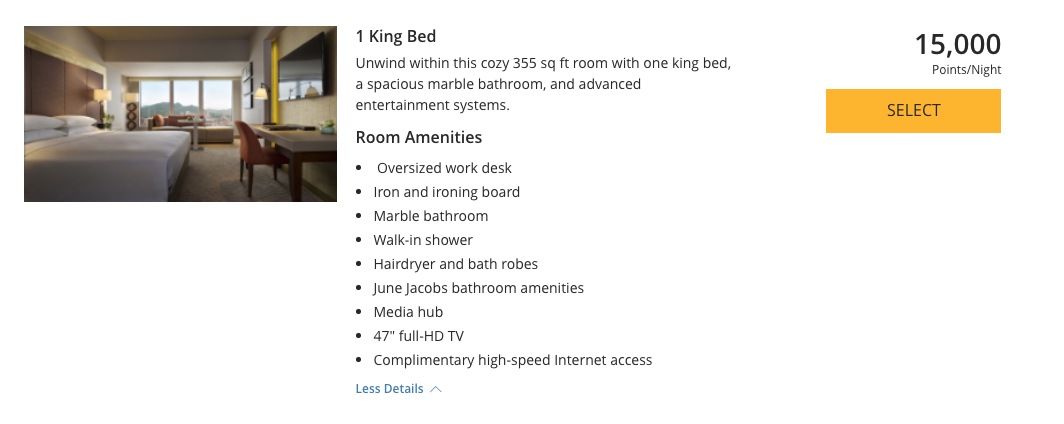

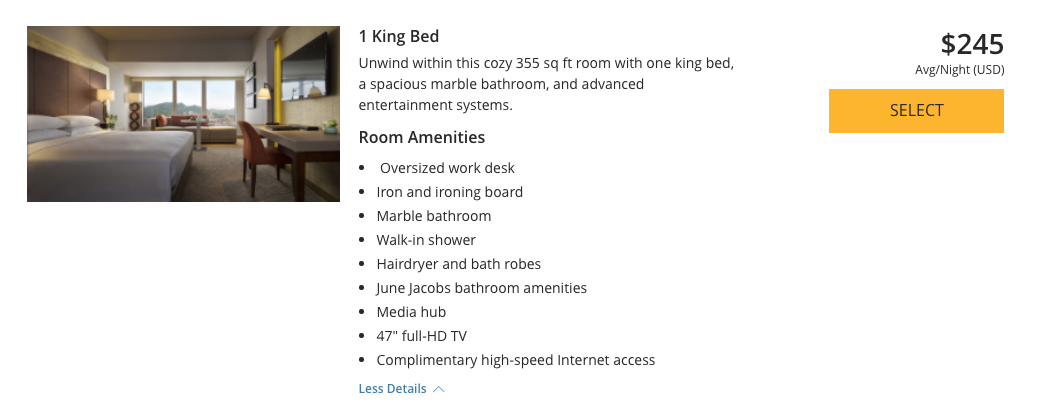

Chase Ultimate Rewards can be really useful. As part of the best award trip I ever booked, I had my dad transfer Chase points to Hyatt to book a room during their layover. With taxes, the room would have cost $280. Getting 1.86 cents per point would make the 100,000 sign-up bonus worth $1,800+.

FINAL THOUGHTS

The Chase Ink Business Preferred is a great card to get for its AMAZING sign-up bonus and to keep for the benefits and bonus categories. If you’re a business that does anything online, earning 3x points on cable, cell phone, and internet advertising is a large amount of your spending. Earning 3x on travel is also a great return.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary