It’s tax season. That time of the year where part of the population gathers paperwork as soon as possible to file for a refund and the rest of us put off the task until the last minute because we don’t want to see how much money we’ll owe the government. In the past, the way to pay the Internal Revenue Service was to write them a check and make sure that it was postmarked by the end of the tax deadline (April 15th, or later due to holidays or weekends). Now that many people choose to eFile their taxes, you can easily add your banking information to have your taxes due removed from your bank account. This is a fee-free option and I’m sure many people take advantage of the ease of doing this. As someone who’s always looking for a place to earn extra points and miles, I was interested when I saw that you can pay your taxes with a credit card…but with a catch.

Let me start by saying that I’m assuming that you have the money to pay your tax bill and the only reason you’d be using a credit card is to earn the points and miles. If you don’t have the money and you’re going to be carrying a balance and paying interest, there are other options available that will cost less than the value of the miles or points you’d potentially earn.

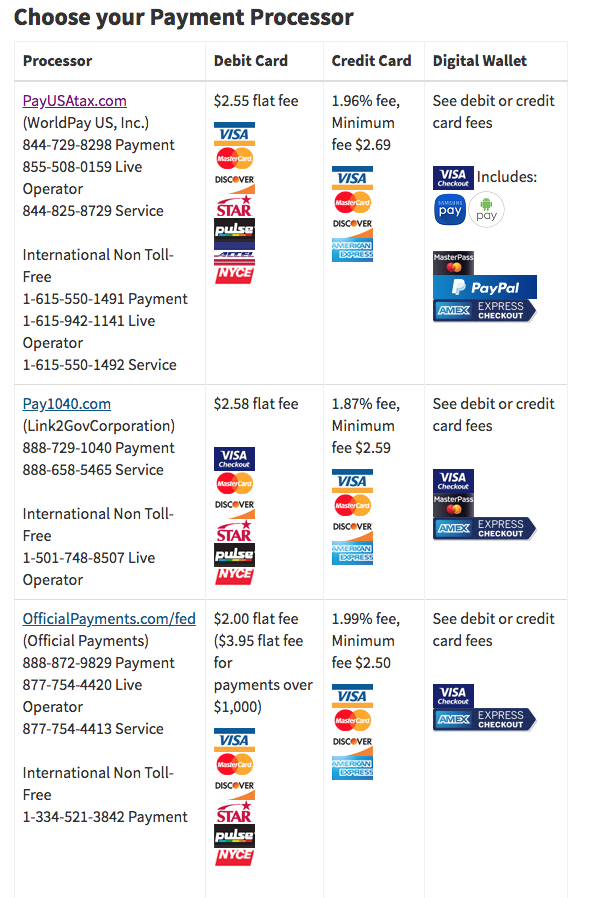

The Internal Revenue Service doesn’t directly accept payments with credit or debit cards. You’ll need to use a third-party service to make the payment and those companies want to make some money for their trouble.

The IRS lists the companies they deal with to process these payments on their website. Pay1040.com has the lowest rates for credit cards at 1.87% of the payment amount, with a minimum fee of $2.59.

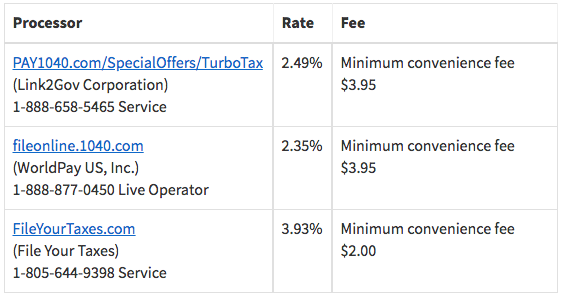

PLEASE NOTE: If you e-file, you will be offered to pay with a credit or debit card from within the tax preparation software. DON’T DO IT!! Here are the fees (from some of the same companies) if you pay from within the program.

I know that going to some external website to pay a large tax bill may seem sketchy and could make you doubt if your payment will ever be received. I’ve used Pay1040 several times with no issues. Just stick to the places listed on the IRS website and you’ll be fine.

I’ve gotten emails in the past from the service called Plastiq, saying you can pay taxes through their website. While this is true, they charge a flat 2.5% fee for all payments. Unless you have a large amount of fee-free payments (earned with referrals), this is a more expensive option and you can do better with the websites above. Not that Plastiq does have a place in earning miles and points, it’s just not here.

Now that you know how to pay your taxes online with a credit card, should you? My answer is a qualified maybe. It’s really a Your Mileage May Vary decision whether the points you’ll earn will be worth more than the money you’ll spend. Any time you take on an extra expense to earn (more) miles, you are, in essence, BUYING those miles with cash. In this example, you’ll be buying the miles or points with the 1.87% extra fee you’ll need to pay to use a credit card.

When It DOES Make Sense To Pay Taxes With A Credit Card

It makes the most sense to pay your taxes with a credit card when you’re going to earn a large credit card sign up bonus with the spending.

My current referral link for the Chase Sapphire Reserve card will give you 60,000 Ultimate Rewards points if you spend $4,000 in the first three months of card membership (and I’ll get a kickback if you sign up for it with my link).

If you pay 1.87% on that $4,000 of spending, that’s an expenditure of $74.80. You’ll earn 60,000 Ultimate Rewards points for meeting the spending requirement. If you redeem that for travel through the Chase Ultimate Rewards Travel Mall, it’s worth $750. That’s 10x the amount you paid to earn those points. If you transfer those points to a travel partner, like Hyatt, you may be able to redeem them for a stay worth over 2.5 cents per point. That means your bonus would be worth $1,500 in value, just for paying $75 in fees on your taxes.

So it’s pretty obvious that if you need to make a tax payment anyway, it would be advantageous to have a credit card with a large sign-up bonus that you need to meet. That’s the best way to get value from having to pay the service fee.

When It MAY Make Sense To Pay Taxes With A Credit Card

There are other situations when paying the service fee might make sense. I was offered a retention offer on my Citi Prestige card where if I paid $1500 per month, I would receive a $50 statement credit for seven months. If I were to pay $1500 to my taxes, it would cost me $28.05 in fees and I’d get back $50. Not a huge payback but not every offer is large. I’d also get back 1,500 Citi ThankYou points worth at least $18.75. That means I’d only be out $9.30 to earn $50. I’ll take 5x my money back all day, every day.

There are other cards where you can spend $30,000 and get a companion ticket on British Airways or spend $250,000 in a year to exempt you from the MQD for Delta Diamond status. If this interests you, there are better sites for you to learn how to do this instead of from me since I don’t spend $250K on cards in a year. 🙂

When It MIGHT Make Sense Pay To Use a Credit Card To Pay Taxes

If you spend $15,000 on the World of Hyatt card, you’ll get an additional free night at a category 1-4 hotel. Considering the $280 in fees you’ll be paying, I don’t think that’s a great return on your money but if you’re close to the spending threshold and this will put you over the edge, it may make sense to go for it.

If you have no other option, using a 2% cash back card like the Citi Double Cash might seem to make sense. However, you’re only making 0.13% on the transaction. $10,000 in tax payments will net you a whopping $13 profit. At that margin, I’m not sure it’s even worth the trouble.

Final Thoughts

I’d only consider paying taxes with a credit card to get a bonus to meeting a minimum spend on a new card sign up bonus. Others might see the spending as a way to meet a large spending threshold but those are only valuable on the margins to specific people so I can’t recommend those options to the masses. The demographic is so specific that it doesn’t make sense for most travelers so I’m not going to go down that rabbit hole in this post.

I still haven’t done my taxes this year so I’m still curious if I’m going to have to pay or get a refund. I do have a card I just signed up for that I’ll use to make that payment if I need to 🙂

Like this post? Please share it! We have plenty more just like it and would love if you decided to hang around and clicked the button on the top (if you’re on your computer) or the bottom (if you’re on your phone/tablet) of this page to follow our blog and get emailed notifications of when we post (it’s usually just two or three times a day). Or maybe you’d like to join our Facebook group, where we talk and ask questions about travel (including Disney parks), creative ways to earn frequent flyer miles and hotel points, how to save money on or for your trips, get access to travel articles you may not see otherwise, etc. Whether you’ve read our posts before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

5 comments

The argument that it DOES make sense to pay your taxes with a 1.87% fee to reach a minimum spend signup bonus is only true if you have no other way or will not otherwise be achieving that minimum spend. Otherwise, you cannot count your purchase and 1.87% fee as earning all those bonus miles which you would have gotten otherwise.

What about paying your taxes with an AMEX biz platinum that offers 1.5x MR for purchases above $5K?

On a $10,000 tax bill you’d get 15,000 MR. Your cost for those would be $189.59. That is ~1.2 cents per MR which makes sense for most.

Thanks for the info. For the signup bonus, I was trying to make a point that you could sign up for an additional card and use the tax bill to reach that spending.

For the AMEX Biz Plat, that’s a great idea which I often overlook since 1) I don’t have a Biz Plat anymore and 2) My personal tax bill hopefully isn’t over $5K.

For those that are, generating MR for 1.2 cents makes sense.

For a business with a $50K+ tax bill, this is HUGE!

Would be even better on the Chase Freedom which offers 3X UR on first $60K.

Is there a limit to the amount you can pay through these sites to the IRS?

Are you referring to the current Chase Freedom Unlimited sign up bonus? I thought that was 3X UR on the first $20,000.

There are limits for payments through these providers.

High-dollar payments must be coordinated with the service provider.

To make a payment of $100,000 or greater through the Link2Gov Corporation, call

1-866-734-8212.

To make a payment of $10,000,000 or greater through WorldPay US, Inc., call

1-855-508-0159.

To make a payment of $1,000,000 or greater through Official Payments,

call 1-888-889-7228.

Paid 50k of business taxes on Jan 1 ’19 (taxes due on end of year payroll). Used JetBlue business card. Got 50k bonus 50K for spend, and Mosaic for ’19 and ’20. Well worth it. Fee was deductible for business. Been paying taxes w/ cc for years.