Once upon a time, the Chase Sapphire Preferred was the darling of the miles and points universe. It earned valuable Ultimate Rewards points with bonus points for spending on travel and dining expenses. Seemingly overnight, it was forced to the back seat because of the introduction of the Sapphire Reserve. With a big brother offering a larger bonus and additional perks for spending in the same categories, the Sapphire Preferred fell into obscurity. Since Chase doesn’t let you carry both cards simultaneously, which one should you get? Since the Sapphire Reserve’s annual fee is $550, the Sapphire Preferred is still a strong contender for people who don’t want to pay that much.

CHASE SAPPHIRE PREFERRED

If you sign up for the Chase Sapphire Preferred by using our referral link, we’d appreciate it because we receive bonus Ultimate Rewards points for everyone who gets the card. Thanks!

Annual Fee

$95 per year

Sign Up Benefits

This card currently has a 60,000 point bonus if you spend $4,000 on purchases in the first three months from account opening.

Per Chase’s rules, this product is only available if you don’t have any Sapphire cards and haven’t received a new cardmember bonus for any Sapphire card in the past 48 months. Applicants must also be under Chase’s 5/24 requirement.

Spending Bonus Categories

The Chase Sapphire Preferred earns bonus points for the following categories:

- 5x points on travel purchases made through Chase Ultimate Rewards, including airline tickets, hotel accommodations, car rentals, activities and cruises.

- 3x points on dining at restaurants worldwide

- 3x points on groceries purchased online, such as pickup or delivery from grocery store chains and meal kit delivery services (excluding Target, Walmart and wholesale clubs).

- 3x points from select streaming services.

- 2x points on travel – from airfare and hotels to taxis and trains.

- 1x point for all other purchases.

This greatly improved from when the card’s bonus categories maxed out at 2x for travel and dining. This puts it close to what you’ll earn with the AMEX Gold Card, its closest competitor.

Temporary Benefits

- 5x points on Lyft rides through March 31, 2025.

- Free DashPass for a minimum of one year, providing zero delivery fees on DoorDash and Caviar when activated by December 31, 2024.

10% Anniversary Point Boost

Every year, on your account anniversary, you get an annual point bonus worth 10% of your total purchases for the year. So, if you’ve spent $25,000, you’ll get 2,500 bonus points.

No Foreign Transaction Fees

As you would hope a card marketed to travelers would, the Chase Sapphire Preferred does not charge any foreign transaction fees.

$50 Annual Hotel Credit

Earn up to $50 in statement credits each account anniversary year for hotel stays purchased through Ultimate Rewards. This benefit has limited usefulness as you won’t be able to earn any loyalty points in a hotel program or take advantage of your perks when booking through Chase. However, I’d use this benefit if you’re ever staying at a hotel with no loyalty program, as long as it’s the same price as booking direct.

Auto Rental Collision Damage Waiver

One of the best features of this card is that it acts as primary coverage when renting a car. In common terms, if you get in an accident in your rental car, you can use the coverage from Chase before filing a claim with your insurance. Most other companies offer secondary coverage (where you need to file a claim with your auto insurance first). I’ve kept this card solely because of this benefit, just in case I ever had to file a claim.

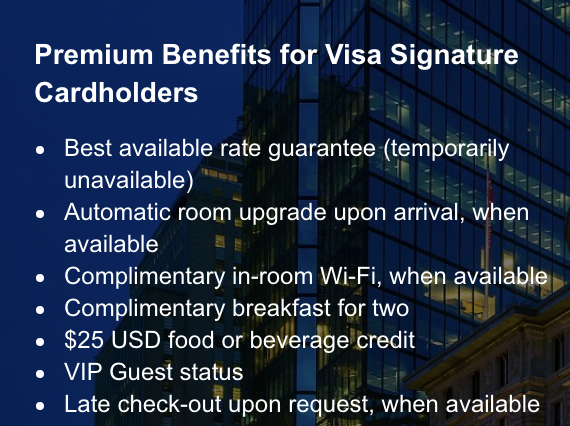

Visa Signature Hotels

The Chase Sapphire Preferred is a Visa Signature card. That provides access to the Visa Signature hotel program. Here are the benefits if you book through the Visa Signature website:

We used this program to get a great discount on our room at the Waldorf=Astoria in Manhattan.

Points are worth 1.25 cents each when using the Chase portal

If you book travel through the Chase portal, your Ultimate Rewards are worth 1.25 cents each. This isn’t the best value for your points, but it is better than the 1 cent you’d get by redeeming them for a statement credit.

Chase Ultimate Rewards can be transferred to other programs at a 1:1 value

Several programs partner with Chase, allowing you to move points to other programs. This enables you to take advantage of the values in multiple programs without being locked into any particular one. Here are the partners of Chase Ultimate Rewards:

- AerLingus AerClub (Avios)

- Air Canada Aeroplan

- British Airways Executive Club (Avios)

- Flying Blue AIR FRANCE KLM

- Emirates Skywards

- JetBlue TrueBlue

- Iberia Plus (Avios)

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

We’ve used Ultimate rewards by transferring points to United Airlines and booking a flight on Aer Lingus business class featuring a lie-flat bed.

We also transferred points to Hyatt for several stays, including one at the Andaz West Hollywood.

FINAL THOUGHTS

The Chase Sapphire Preferred has a valuable sign-up bonus and is worth keeping for the benefits and bonus categories. Using this card for primary collision coverage might be worth the annual fee if you rent cars often. If you’re starting out, this is a great entry-level card. You can get started redeeming points for flights or hotel room nights. Once you can make some redemptions, you might become a full-fledged points and miles fan.

Want to comment on this post? Great! Read this first to help ensure it gets approved.

Want to sponsor a post, write something for Your Mileage May Vary, or put ads on our site? Click here for more info.

Like this post? Please share it! We have plenty more just like it and would love it if you decided to hang around and sign up to get emailed notifications of when we post.

Whether you’ve read our articles before or this is the first time you’re stopping by, we’re really glad you’re here and hope you come back to visit again!

This post first appeared on Your Mileage May Vary

4 comments

[…] reports I’ve found, this offer is being sent to people who have the Chase Sapphire Reserve, Chase Sapphire Preferred or the Chase Freedom Unlimited cards. Purchases need to be made with Apple Pay, meaning you must […]

[…] of 40,000 points is worth $560 in airfare. If you can meet the $4000 spending requirement, the Chase Sapphire Preferred’s sign up bonus of 50,000 points is worth $625 or more. The Starbucks’ Visa initial sign up bonus value of $200 was really disappointing since to […]

FYI, I still get emails from Chase that offer me 20k referral and 100k for approved accounts. The ending date says 1-4-22. I assume other people getting same emails.

I have been a CSP loyalist until the Capital One Venture X Card. The card benefits are a nearly perfect overlap, with the Venture X having some extra ones.